Below is the transcript of the video you’ll get access to with your subscription.

Hello folks, this is Ralph. And today I’m going to show you how to use the cumulative sum study for the NYSE TICK. So if you haven’t already done so please go ahead and watch the set up video so that you can get this chart set up on your system. I’m also going to add to this chart, the e-mini S&P futures so that we can see price along with a, with a $TICK.

So to do that, I just need to find that you e-minis in here.

There we go. Let it load for a second. And for some reason I noticed that price is multiplied by a hundred for some reason. So don’t mind that too much. I have no idea why or maybe it’s multiplied by a thousand, but anyway, um, I want to show you how you can use the cumulative sum and also the bubble for your advantage.

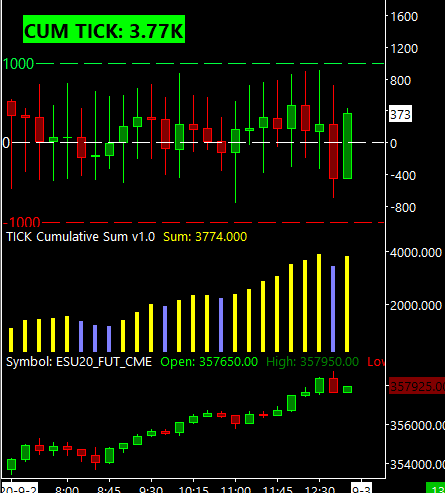

So if we’re looking at just the five days that we have on the screen here, and you can see where the day star by just looking down here at the timescale. There’s two days that have some good divergences one, which is very obvious. And the other one that is very subtle and I’m sure that we could find others, but I want to talk about this day first, and then I want to talk about today.

I’m actually remaking this video today because I liked the setup today that I traded. So first let’s go over this day, as you can see at some point during the day we liquidated, right? And, the cumulative sum was also trending down in tandem with price, which is something that you would expect. But at some point in time, we actually start trending up.

And this was a very, very apparent trend of we did four bars trending up while price was still making lower lows. So if you think about it, the e-mini S&P tracks. The S&P 500, which has 500 stocks, even though we’re looking at the NYSE TICK, which is all the stocks in the New York stock exchange, which is thousands of them.

A lot of those stocks are also trending with a broad market, which is the majority of stocks. So it’s a good proxy. I don’t, I don’t like to use the tick just for the S&P because it’s not enough data and you don’t get as accurate data. So this is why I use the nice tick. So the opportunity that this presents is knowing that price likely for the e-minis overshot, essentially because of emotions, there’s lot traders, you know, people are throwing up their positions.

So then we kept trading down, but the underlyings did not. And sometimes, you know, these divergences happen and it’s what really provides good opportunities and sure enough, overnight we trended up and then we essentially opened. If you sort of eyeball, you know, where we stopped right here and then start turning up, you know, this price for that bar is around this area, and sure enough guests where we opened up? Just in that exact spot. And that just gives you confidence, right? By looking at the TICK over a long period of time, you sort of gained this confidence on the fact that these events will happen so you can trade them another example, which I believe you probably need a magnifying glass for this one… is today’s trade.

So we traded down again. We had some nice liquidation today and then, if you look at this red candle right here, and then you look at this green candle, but this green candle now aligns with this yellow candle up here. Yellow means that we’re adding where we have a higher value for the cumulative sum than we did previously.

But price itself has not really cleared the previous high. And I know this is going to be difficult because you don’t have a lot of data to go off. You only have one candle that has now trend it up, but, but I already had the feeling that we were going to bounce back and it was just about finding a good reason or more reasons than the ones that already had.

Maybe I had levels, maybe I was looking at order flow and looking at this just gives me an additional data point as to where the market could potentially be going. And sure enough, we traded up, I caught some of the move and it was a great trade. So that’s how I like to treat the cumulative study.

There’s a bunch of other ways, but I think that sort of gives you a good start. You should definitely be looking at this to get used to the data, to get used to looking at it, see how it trades. Um, the other thing that I just want to go over is the bubble. And I created this bubble because I don’t actually like looking at this chart that often.

And I mainly want to know what the value of the cumulative sum is. Not the value of the, of any individually tick bar. I don’t really care about that. I care about what the sum is, and I keep that record in my mind throughout the day. Right. Because I’m focused. That’s what I’m looking at. I remember that now we’re at 718 or in the 700s.

And then, you know, I’ll look at it a little bit later and be like, okay, we’re turning up, we’re turning down. And that’s fantastic. One thing that the bubble also gives you is it can tell you if we’re actually in a trend. So once we’re trending, for example, potentially this bar right here. I’m not sure if it’s actually higher than this bar right here, but if it were even this one right here now, it’ll, it’ll start telling you that we’re in a trend and this just means that more stocks are now trending up than the amount of stocks that were trending up before, it’s that simple. And that continued, continued continued until at some point in time, we sorta started plateauing. And this won’t tell you if we’re plateauing, but it’ll tell you that we’re no longer trending. And that’s the other piece of information that is valuable is like we’re no longer trending, you know, maybe things are changing also the e-minis haven’t.

I mean they’ve moved up, but they haven’t moved up that much. So it adds more data points to other data points that you may have in your head to give you the confidence. So take a trade to the downside potentially. But the thing that you can expect from the bubble is you can expect next to the number.

If we’re in a trend up, it’ll have a carrot that is pointing up. And then if we’re trending down, it’ll have a carrot that we’re, that is pointing down. So that’s something that you can expect and you can see it at a glance versus having to flip over to this chart all the time. The last thing that I want to go over is the bubble can also tell you if we were previously negative or positive, and now we’re on the other side of the zero line.

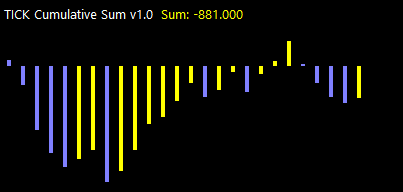

So let’s see if we can find a good day. Where this occurred. So it’ll pick up on these days where it trends up and then it turns down and it goes below the zero line. If we look at the settings for this bubble, this is the minimum value. This setting right here is when it’ll record if we actually were on the other side of the zero line.

So let’s find a good example of a day where this happens. Mmm. Let’s go to the beginning of the chart here. So this is actually a pretty good example where we, because we were positive here, look at the right it’s around 627, 630. So this one, it wouldn’t have recorded that we were positive here because we hadn’t hit that Mark.

And then we went negative. Two 574. Again, it wouldn’t have recorded that one, but then we flip back to be positive and you can change that threshold. Sometimes I’ll change it myself, but say we had it at 500, right? So then once we came back positive, it would tell you, Hey, we were negative previously and now we’re positive.

And that again just tells you that the different stocks of the market are shifting from negative to positive or the other way around. Let’s see if we can find a better example.

So this could be a good day. And again, I don’t know if, if the value will, will match what I have in my settings, but actually a will. So this value is 723. We know that. The threshold that we have is 650. We just looked at it. So at some point in time, we were trending down for the broader market. And then we chopped around, up, down, up, down, up, down, and then we actually started trending.

If you get a value around this area, again, we’re like looking at 700 in the seven hundreds positive now it’s around this bar right here. This should give you the confidence to get into a long position. The market previously in the day, at some point in time of the day was mostly negative. So there’s means that there’s been a shift in the market and that momentum is likely going to continue and you can get behind it.

So I hope these few examples made a lot of sense and you can use them to your advantage. Of course, there’s a lot of other ways to trade the TICK and, and we’ll go over some of those in the other videos. So until next time everyone happy trading.