Below is the transcript of the video you’ll get access to with your subscription.

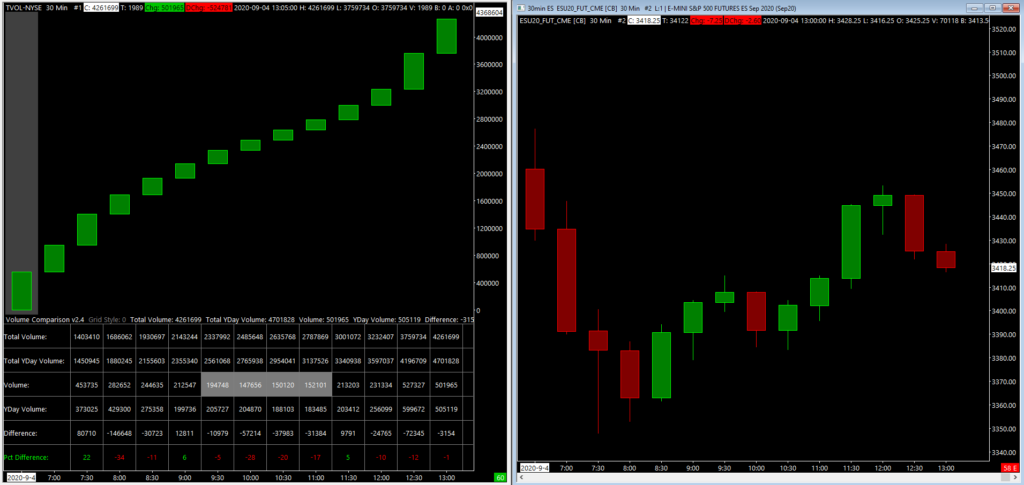

Hello everyone. This is Ralph. And today I’m going to show you how to use the volume comparison study in your everyday trading. So let’s get started. What you’re looking at here is the total volume chart on the left and the e-mini S&P futures on the right. Both of them are 30 minute charts. And I have the scrolling Singh so that when I strong won, the other one will also follow.

And on the total volume graph, I’ve also added the Von comparison study, which is what we’re talking about today. So the way to use this in your everyday traiding is you want to use this study when the market is trending. That’s really what the study tells you. If the strength of the move is strong and it’s backed by the cash market, or if the move is simply happening on the future side of things and will likely reverse at some point in time.

And that’s what can give you a good trade setup as well. Well, as potentially following the trend. If you know that the trend is strong. So. As we talked about, you want to wait for the trend? If we look at this area right here, we’re just in range, right. And I’ll draw a low rectangle around it so that you can see what I’m talking about.

Market’s going up, down, up, down, nothing really happening. This is not a trend, but on the right, we have a great example of a trend. We ranged a little bit in the morning. And then we started training up. I’ve highlighted the overnight session in this blue background so that you can tell the difference simply because the data for the total volume of the New York stock exchange only occurs when the cash market’s open.

There’s no overnight data coming from the chart on the left. Okay. So if you look at the data for this day to validate, if the trend was strong or not, we can look now over on the left. And you can see potentially, maybe you’d recognize a trends in one of these candles, maybe one, maybe on this breakout candle.

If we look at the left hand side, you can see, this is our breakout candle. You can see that this is just shy of not printing the grey background, meaning that the strength of the trend is strong and it only gets stronger as the day progresses. Usually these periods will always have a gray background simply because there’s less players involved in the market.

So it’s always something to keep in the back of your mind. In my opinion, this was a strong trend. I should have not faded it and I should have gotten long at some point in time. If I wasn’t already long, let’s see if we can find other examples.

These, these are two good little trends, but they’re so short that it doesn’t really give you the opportunity to leverage the study. Here we go.

So again, at some point in time, you want to ask yourself, are we in a trend if we’re in a trend, look at the volume comparison study. So maybe you’ve realized that the futures are trending now. And at this point in time at eight 30 in the morning, you glance over to the volume comparison study and you see that the last few periods had a lot of volume.

The next period. And again, this is the beginning of lunchtime in New York, which is just shy of the 200,000 average that I have sat for the study. So I would say it’s, it’s mildly strong to strong, um, at this level. And then, so we continue knowing that there will be less volume over the next couple periods, and then eventually we get another big volume period followed by another big volume period. They’re just shy. I know they’re printing gray, but they’re just shy of 200,000, which will make them not prank gray. So in my opinion, there is just no reason. If you look over here, there would be no reason for you to start shorting in this area.

Especially these two periods, you should be getting long waiting for the move up at the end of the day. And this would have been a great trade because you have little risk. You can wait to, to try and get in as close as, as you can, to the bottom of this range that you’ve probably already identified.

Right? So this is a range. And you want to get in long, somewhere down here so that you have a very short stop, you know, you’re out and then you have a lot of reward if it works out. So that’s essentially how you want to trade this study. I hope you found this video useful and can incorporate it into your everyday trading until next time everyone, happy trading.