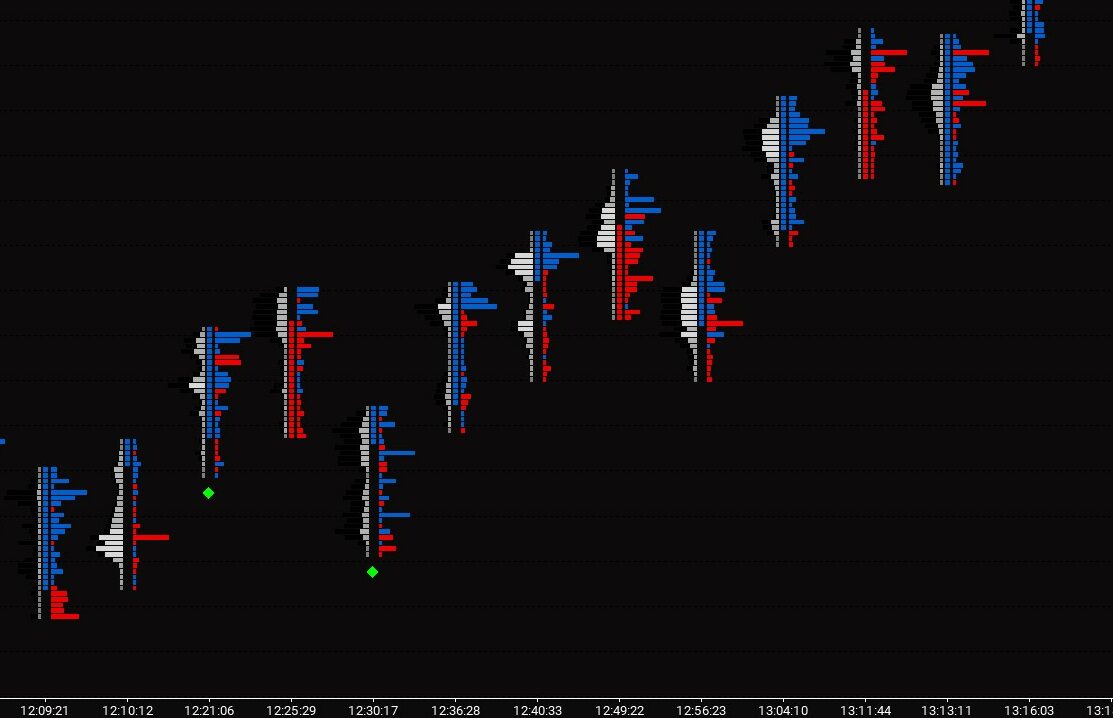

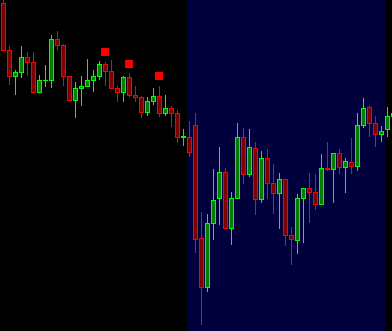

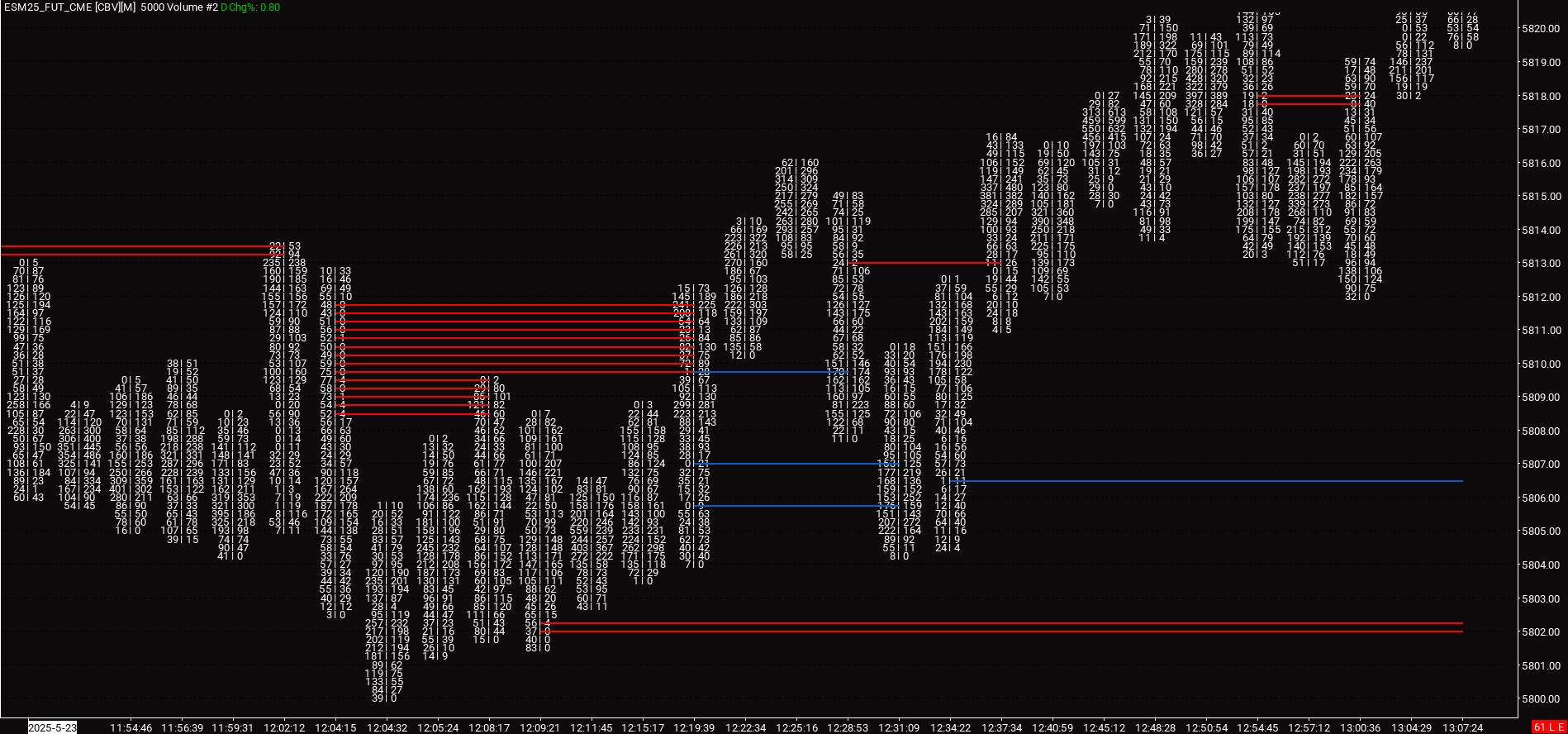

Sierra Trading offers a specialized suite of studies designed to extract actionable signals from bars, which traders typically do by closely observing Footprint charts. These tools focus on auction completion, exhaustion, imbalance, and structural inefficiency—giving active traders a precise read on market behavior beneath the surface of price.

Whether you’re trading reversals, reading tape, or mapping high-probability re-test zones, these studies provide an essential edge.