Our studies provides a real-time, options-driven view of market structure—designed to help you anticipate volatility, identify key price levels, and understand where dealer flows may create support, resistance, or acceleration zones.

Our studies provides a real-time, options-driven view of market structure—designed to help you anticipate volatility, identify key price levels, and understand where dealer flows may create support, resistance, or acceleration zones.

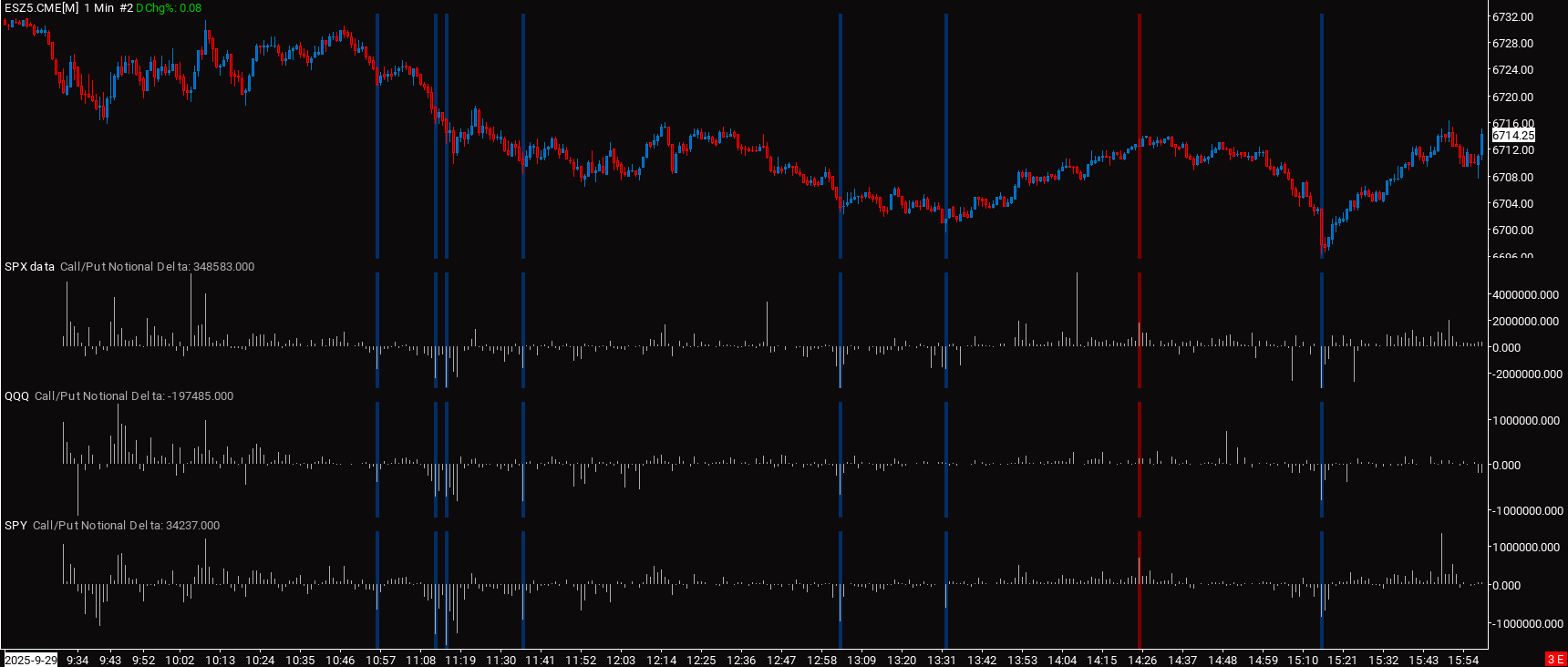

A live, intraday visual of Gamma Exposure (GEX) and Delta Exposure (DEX) for 0DTE SPX options.

High-conviction support and resistance zones derived from options positioning.

A centered heatmap view of the most impactful options strikes surrounding the current price.

Statistical insights into real-time options flow extremes.

© 2026 Sierra Trading. Full Risk Disclosure