The Gamma Exposure Study provides a real-time, options-driven view of market structure—designed to help you anticipate volatility, identify key price levels, and understand where dealer flows may create support, resistance, or acceleration zones.

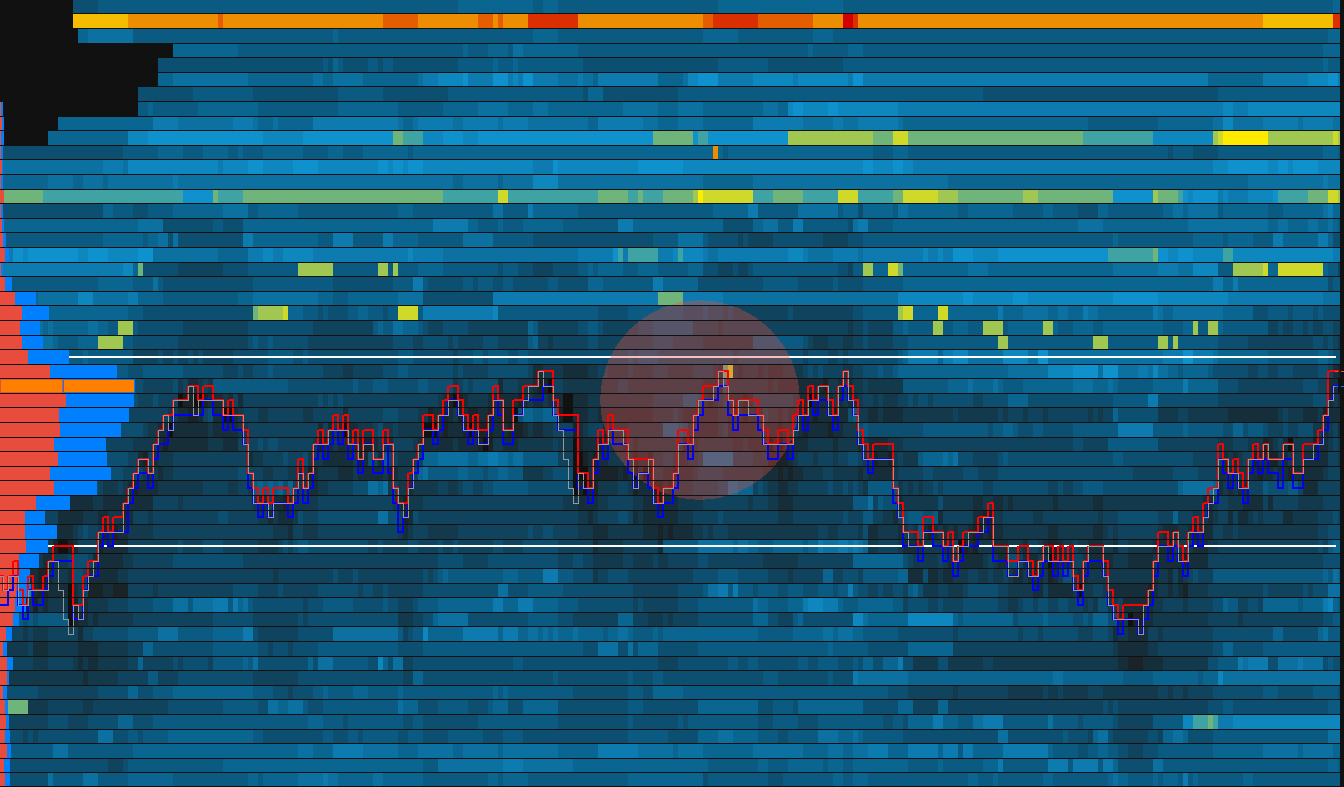

Liquidity Imbalances

Expose Hidden Pressure with Real-Time Book Imbalance Detection

Liquidity Imbalances tracks order book pressure using ATR-scaled depth and statistical thresholds to highlight when the bid or ask side materially outweighs the other. Signals plot only when both dynamic and volatility-adjusted thresholds are breached—revealing true supply/demand dislocations.

Use it to:

- Detect hidden buying or selling pressure before price moves

- Anticipate squeezes, stalls, or directional accelerations

- Identify actionable shifts in book sentiment near key levels

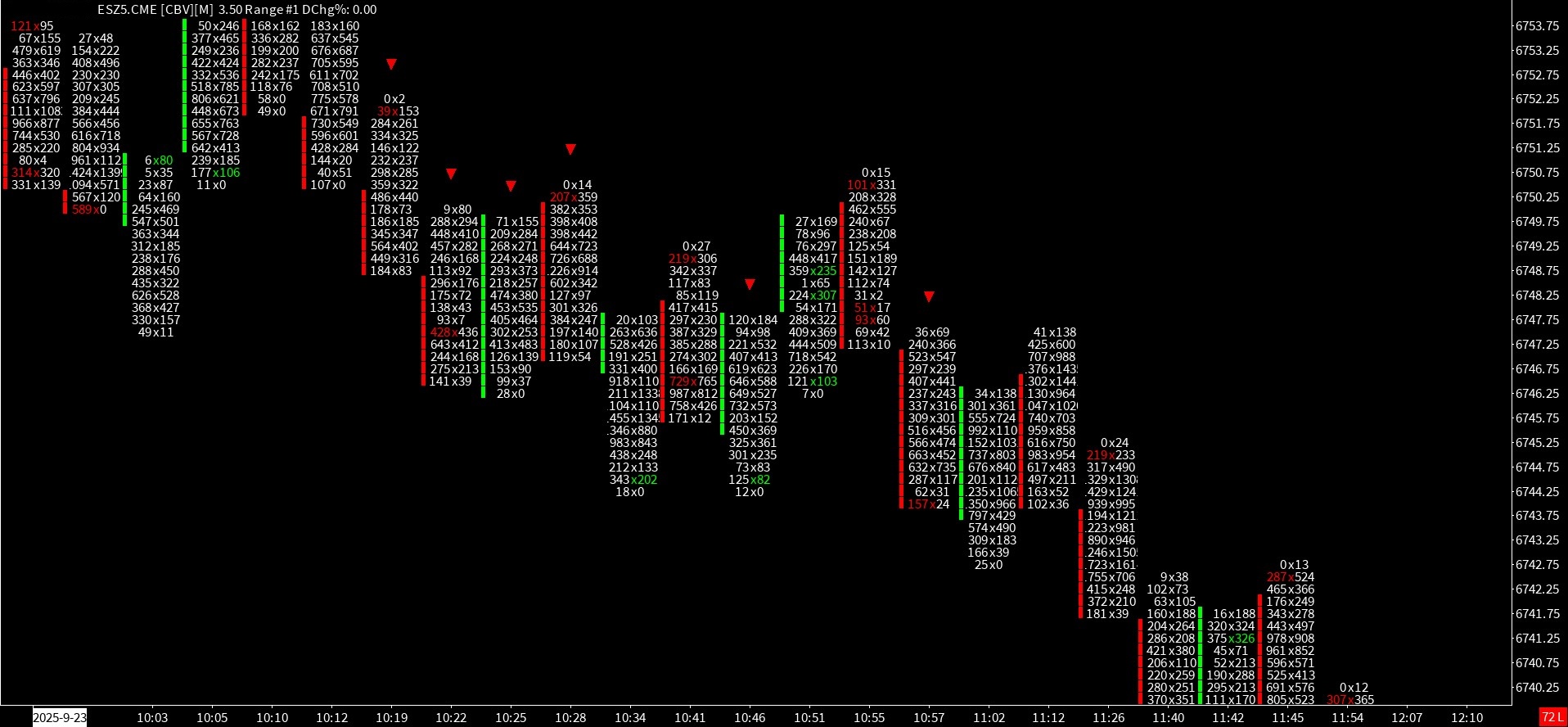

Orderbook Liquidity Alert

The Orderbook Liquidity Alert study monitors real-time market depth to detect and alert on clusters of significant bid and ask liquidity. It’s designed to help traders anticipate potential inflection points, where large resting orders may act as support or resistance—or signal the intent of large participants.

Key Features:

- Custom Alert Criteria: Define minimum order size, number of price levels, and the lookback range to detect meaningful liquidity events.

- Separate Bid/Ask Alerts: Unique alerts for each side of the book let you distinguish between buying and selling pressure.

- Smart Throttling: Prevents alert spam with configurable price and time spacing between triggers.

- Efficient Operation: Optimized to check for new events only at set intervals, minimizing impact on chart performance.

- Easy to Configure: Intuitive settings let you tune sensitivity to your market and strategy.