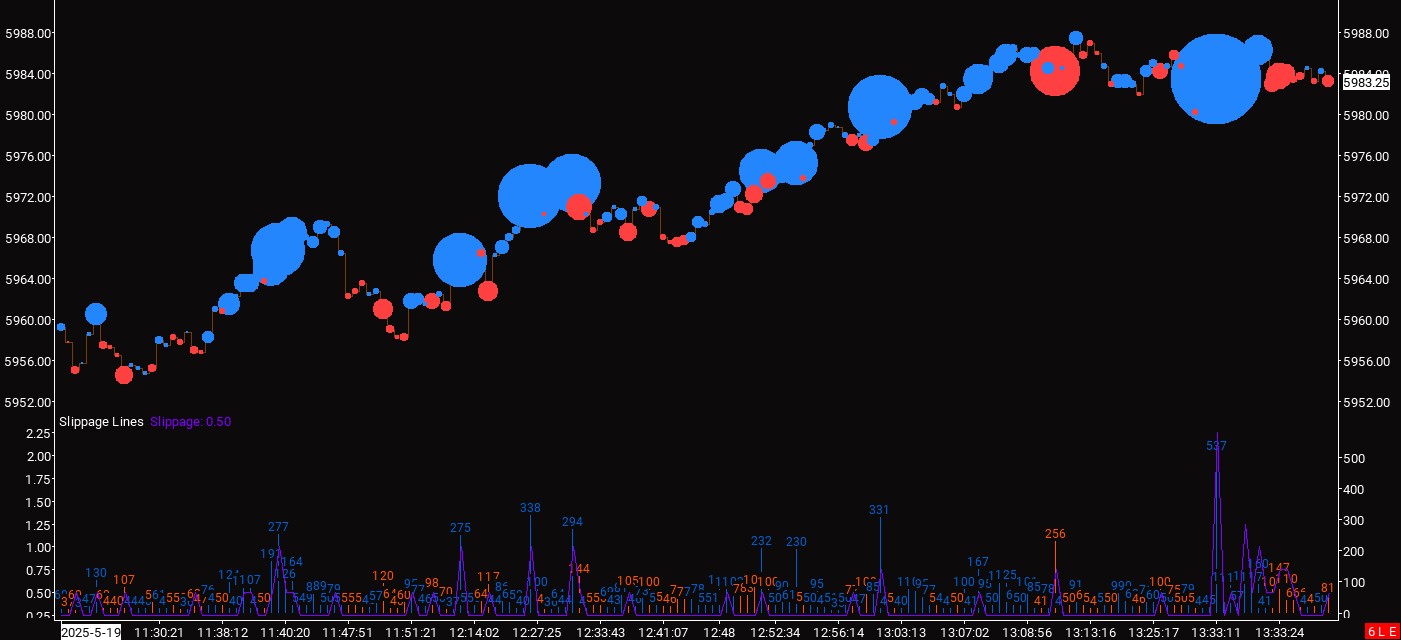

The Reconstructed Tape study is the centerpiece of Sierra Trading’s Order Flow Suite—designed for traders who want to see beneath the surface of price and track the real behavior of aggressive participants, large players, and liquidity shifts.

This isn’t a traditional volume tool. It’s a custom-built order flow engine that rebuilds trade data into actionable structure, helping you identify momentum ignition, slippage, and institutional intent with clarity and speed.