The Strategy Tools suite includes targeted studies designed to enhance trade execution, risk management, and structural clarity. These indicators support a variety of strategies by providing adaptive stop placement, dynamic price positioning, and clear pivot reference levels—helping you manage trades with greater precision and consistency.

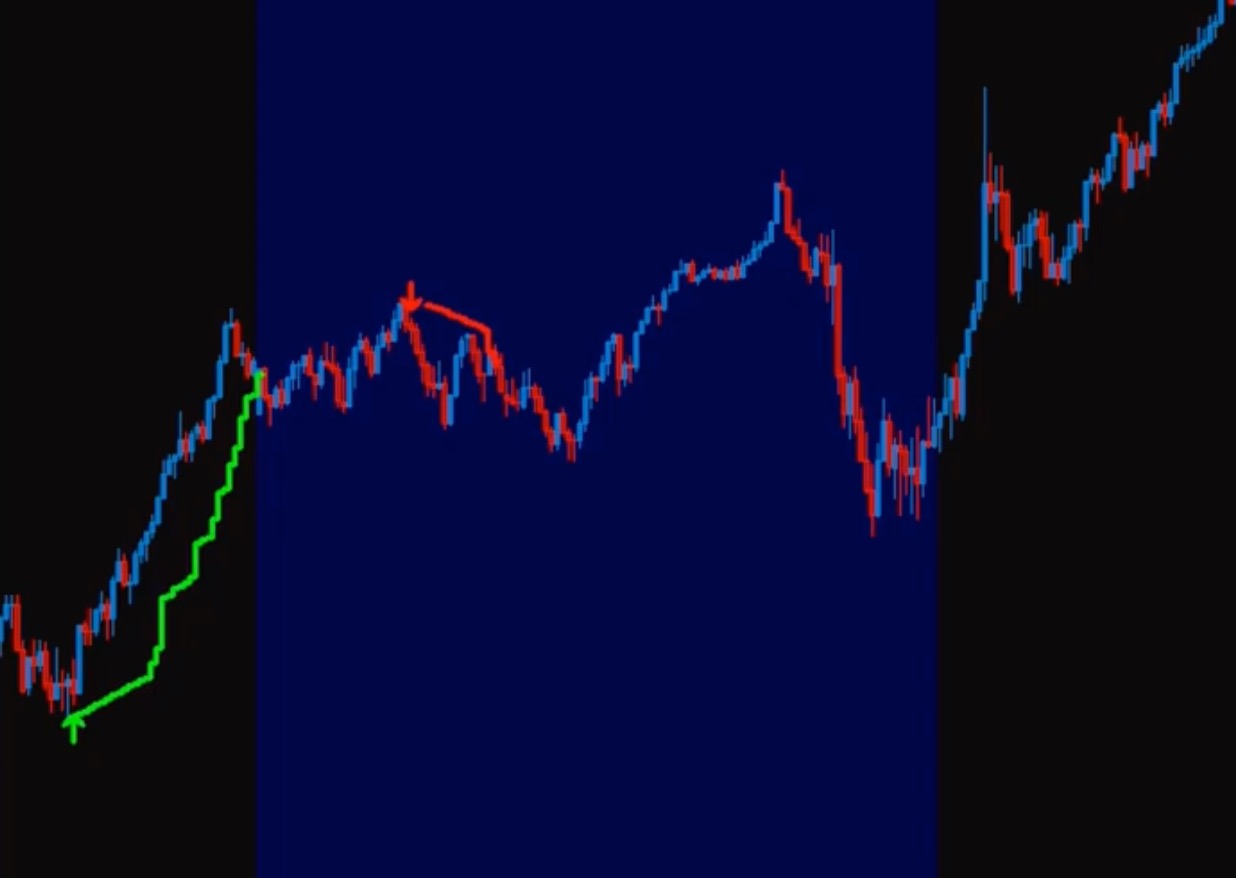

Dynamic Stop Loss

Purpose: Automates and adapts stop loss placement based on volatility and price movement.

How It Works: This study calculates ATR-based stops that evolve with market conditions. You can customize profit triggers, select between real-time and back-calculated modes, and integrate it with your long/short entry signals. The result is a responsive stop mechanism that removes guesswork and helps protect profits.

Ideal For: Traders who want objective, adaptive stop placement integrated directly into their strategy.

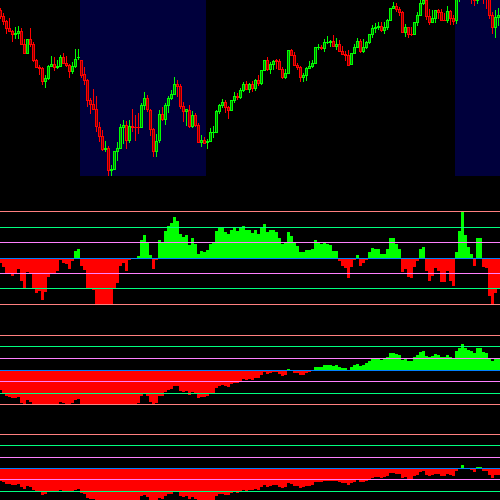

Linear Regression Location

Purpose: Quantifies how far price has deviated from its trend, using dynamic regression analysis.

How It Works: Calculates a rolling linear regression line and standard deviation bands, then assigns each bar a “location score” to show where price sits within the trend channel. Color-coded histograms highlight overbought/oversold conditions or mean-reversion zones.

Ideal For: Traders looking for statistically grounded context to time entries, exits, or reversals.

Pivot Line

Purpose: Highlights key price levels based on historical session data.

How It Works: Automatically draws a horizontal line at the average of the high, low, and close from a user-defined number of bars ago. It’s a simple yet effective reference point for intraday or multi-day support and resistance.

Ideal For: Traders who rely on pivot-based analysis or need consistent reference levels across sessions.