Divergence Detector RSI

Below is the transcript of the video you’ll get access to with your subscription.

Hello folks, this is Ralph. And today I’m going to show you how to use that divergence detector study for the RSI, if you haven’t already done. So please go ahead and watch the setup videos that you can get the same chart that we’re looking at right now. I’m picking up right where we left off from the setup video.

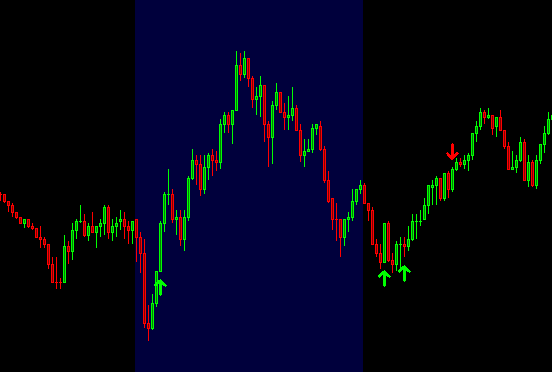

I haven’t changed any of the inputs. And today I want to show you two different trades. I’ve already turned on the SIM trading for Sierra chart, as you can see up here, and I want to go over two different setups, one that will work. And that’s the one that we’re looking at on our screen right now. And the other one that we will get stopped out.

And the main reason why I want to do this is so that you can see how I handle both setups. All right. So let’s get started again. We’re going to be trading this setup right here, and I’m just going to go to replay mode and start the replay from this period.

So we have it right here and I’m going to posit as soon as I see the arrow plot, which should be in the next candle.

There we go. So at this point in time, if you have it set up to give you an audible alert, the study itself will send out the audible alert and it’ll also paint the error on the chart. At this point in time where you want to do is make a decision if you want to enter or not. And your entry, depending on how aggressive you want to be, you could enter right now.

And from this low, from the swing low, you have a risk of about two and a half to two and a quarter points. Obviously what you want to do is enter as close as possible to this low, to the swing low, because that’s where your stop should be. All right. So I’m going to change the speed of the replay to one, and I’m going to buy the market here

and then I’m gonna place my stop right underneath the low.

All right. So usually I like to place at one tick below the low other folks prefer to put it exactly at the low, but I’ve seen it many times that it comes exactly to the same low and then it will bounce back up. So it’s completely up to you. Whatever you want to do. Um, and now I’m just gonna speed the replay up.

As you can see, it’ll just work out. This is a very simple trade. You don’t really have to do much with it. And really the only decision that you have to make here is if you want to move the stop and you can as price trading up so that you can lock in the profits. And there we go. At some point in time, you’ll obviously going to want to take the trade off, but I think for me, what I would do here is I would take the trade off around this high right here. Or at least I would observe how it’s trading around this high. So obviously we cleared it without any red candles. And then at some point in time, we got a red candle and kept turning back down. I probably would have waited till this point and taken the trade off because you just never know what’s going to happen.

Right. And then potentially, maybe gotten in again. At this area down here or at this area down here, but that’s a completely different trade. So what I’ll do now is I’ll take this trade off we’ll flatten and then we’ll stop this replay and go and find the other trade that I wanted to show you.

It’s a little bit back here. So just bear with me while I scroll to the right spots. We’ll pass the trade that we just traded should be coming up right here. And then I just want to trade this area right through here. So you’ll actually see me trade both of these setups and, you know, I think the better trades come whenever you trade the divergences, whenever they are also matching up to something else, for example, level or whatever, right.

It doesn’t really matter. Maybe there’s another high around this area back here and you want to take the trade. So let’s assume that that is the case, or maybe it’s not, and you just take the trade, but let’s go ahead and start the replay. And I just need to look at the time that I need to start it out. So around 12:25 on 7/31.

Alright, so let’s go ahead and start it and we’ll be shorting the market. It’s going to slow it down a little bit here. So now it’s painted this red arrow right here. And what you’ll want to do is obviously take the short, if everything else, you know, aligns with your trading system. So let’s go ahead and take this short right here and sell the market.

And what I want to do is place my by stop, right above this high. So right here, and you know, this will get stopped out right away. As we saw on, on data before I started the replay.

And there we go. Now we got stopped out and that’s essentially how you want to trade it. You don’t want to keep adding to your position. You just want to be in place your stop, forget about it and don’t mess with it. And now we’re going to get the double divergence here in a moment and I’ll stop the replay again, slow it down and then place the trade again.

There we go. So now we have the double divergence. I’m just going to stop here for a moment and explain one other thing. So I’m going to zoom in here and. You know, sometimes what will happen is, and we saw it on the first trade. If you want to rewind the video, but the next candle, the candle that the alert plots or the following candle will sometimes trade back up.

And that’s usually great opportunity to get into the trade. All right. So you could wait until price comes right up here and then take your short, super tight stop. And if you’re right, you’re going to have a really nice payday. If you wrong, you only lose a little bit. So again, I’m going to slow down this replay and then I’m going to place the short again here.

You know, if you want to be very careful again, you’d want to wait for price of trade up a little bit, then take the short.

We’ll put our buy stop right up here. One tick above is usually how I like to do it.

I’m getting all this confirmations. I promise that’s not how I normally trade. It’s just that I’m in a different CRM instance. And there we go. So now we got stopped up. So very simple, tight risk. As you can see in the first trade that we took, we got paid really nicely. And in these two other ones, we lost quickly and lost a little bit of money and that’s where you want to try and achieve.

So I’ll leave it at that. I hope you learn something here and if you have any questions, please let us know until next time everyone, happy trading!