Order flow is the foundation of all trading strategies. Whether you rely on technical analysis, candlestick patterns, or momentum-based approaches, every market movement is ultimately driven by the dynamics of order flow—the buying and selling that dictate price changes. Despite its fundamental role, order flow remains one of the most misunderstood and elusive concepts in trading. Many traders struggle to grasp its mechanics, yet mastering it can provide unmatched clarity and precision in understanding the market.

Order flow trading is a fascinating market analysis technique that allows traders to dive deep into the dynamics of buying and selling activity. Unlike traditional methods relying on historical data, order flow trading provides real-time insights into the market’s heartbeat by analyzing live transactions and resting orders. In our opinion order flow should be the cornerstone of any trader’s strategy.

In this guide, we’ll explore the core concepts of order flow trading, the tools used to implement it, its benefits, and practical strategies.

What Is Order Flow Trading?

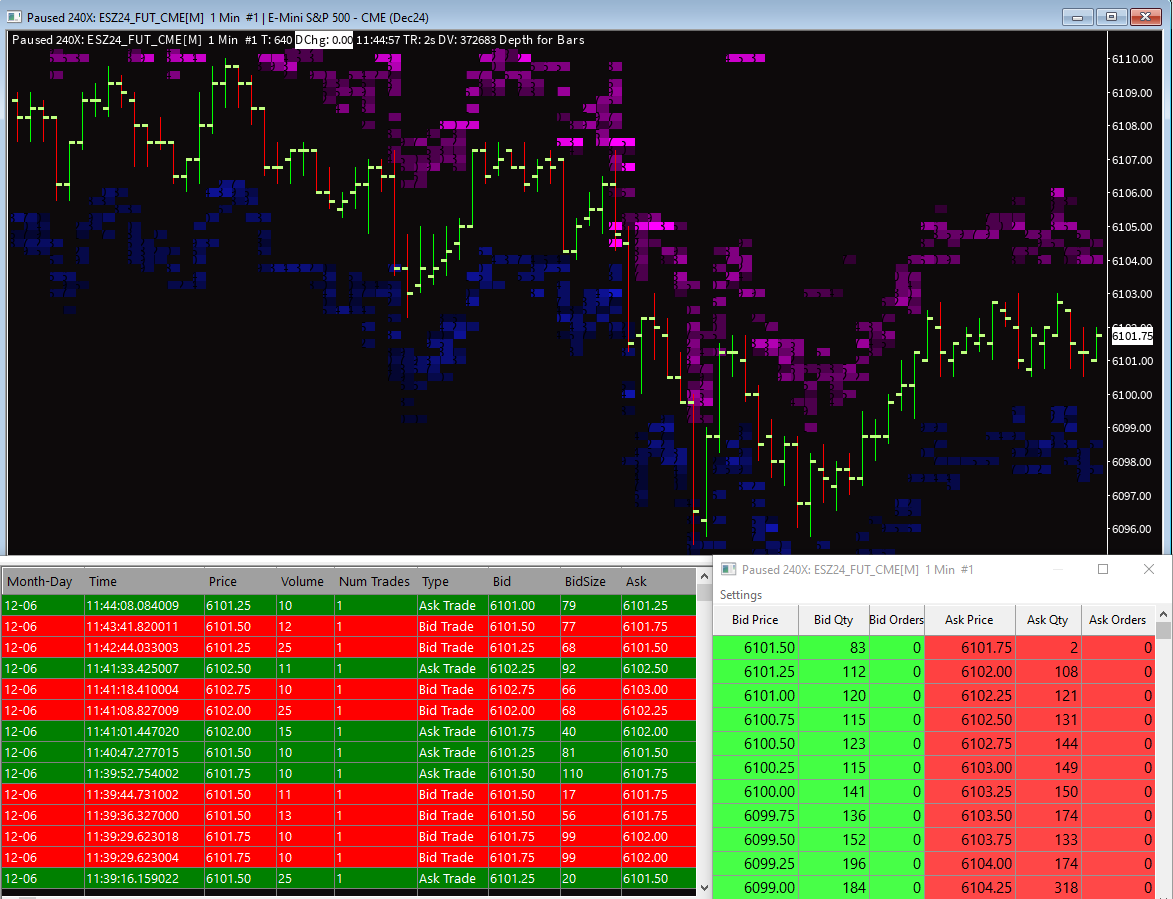

Order Flow Trading (OFT) is a strategy that focuses on analyzing the flow of buy and sell orders to predict future price movements. It provides traders with real-time data, often referred to as the “auction” between buyers and sellers. This data is sourced from tools like the Depth of Market (DOM) and Time & Sales, offering a clear view of who controls the market at any given moment.

Unlike traditional indicators such as moving averages or Bollinger bands, which are lagging and rely on historical data, order flow trading reveals the live interactions of market participants. This immediacy allows traders to make informed decisions based on current market conditions rather than outdated signals.

The foundation of order flow trading lies in auction market theory, which posits that prices move due to imbalances between buyer and seller aggression. By understanding these dynamics, traders can identify areas of fair value, imbalances, and potential opportunities.

Tools Used in Order Flow Trading

Order flow trading requires specialized tools to visualize and analyze market activity. Here are the most common ones:

1. Depth of Market (DOM)

The DOM displays resting buy and sell orders at various price levels. It allows traders to assess liquidity and determine areas of potential support and resistance. Observing these levels helps identify low-risk entry points and monitor how orders transact in real-time.

2. Time & Sales (The Tape)

Time & Sales provides details of executed trades, including price, volume, and timestamps. The color-coded data highlights market activity, such as aggressive buying or selling. Placed alongside the DOM, it helps traders gauge momentum and sentiment.

3. Volume Profile

The volume profile shows traded volume distributed across different price levels. By analyzing areas of high and low volume, traders can pinpoint price zones with significant market interest and potential breakouts or reversals.

4. Delta

Delta measures the difference between buying and selling activity (ask volume minus bid volume). It highlights market aggression and provides clarity on one-sided movements, helping traders understand the strength behind price changes.

5. Footprint Charts

Footprint charts, or number bars, combine candlestick data with buy/sell volume and delta. They provide granular insights into intraday auction activity, revealing areas of absorption, initiative buying, or selling.

Benefits of Order Flow Trading

1. Real-Time Insights

Order flow trading offers immediate data, allowing traders to act based on the current state of the market rather than lagging indicators. This real-time access is invaluable for understanding participant behavior and anticipating market moves.

Large traders can manipulate price with their large accounts, but one thing they can’t do is hide their intentions as every order in the futures market is visible for everyone to see.

2. Tighter Risk Management

By observing where major players are positioned, traders can set precise risk levels. Knowing when and where the market might turn lets traders exit trades early if conditions change, reducing potential losses.

3. Enhanced Confidence

Order flow trading provides a clear picture of market dynamics, helping traders make decisions with confidence. This clarity reduces emotional stress and fosters disciplined trading.

Order Flow Trading Strategies

1. Absorption and Exhaustion

Absorption occurs when large buy or sell orders are met without significant price movement, indicating strong support or resistance. Exhaustion happens when one side of the market runs out of orders, often leading to a reversal or breakout.

2. Volume Profile Trading

Traders use volume profiles to identify high-volume nodes (support/resistance levels) and low-volume nodes (zones where prices move quickly). This strategy is effective for both trend and range trading.

3. Order Book Imbalance

Analyzing the imbalance between buy and sell orders can reveal supply and demand disparities. A large imbalance often predicts price movement in the direction of the higher volume.

Misconceptions About Order Flow Trading

Order flow trading is not a “holy grail” strategy. While it provides unparalleled insights, it requires practice and experience to master. Here are a few common misconceptions:

- Easy Profits: Success in order flow trading demands time, effort, and discipline.

- Guaranteed Wins: No strategy is infallible, and order flow trading is no exception.

- Risk-Free: Understanding market dynamics doesn’t eliminate risk; it only helps manage it better.

Practical Advice for Beginners

- Start with foundational tools like the DOM and Volume Profile.

- Spend time observing market activity to recognize patterns. Time in front of the screen is what will make you successful.

- Use demo accounts to practice order flow strategies without financial risk.

- Incorporate order flow analysis with traditional technical tools for a comprehensive view.

FAQ

What is the main purpose of order flow trading?

The main purpose is to analyze real-time buy and sell activity to understand market dynamics and make informed trading decisions.

Is order flow trading suitable for beginners?

Yes, but it requires patience and practice. Beginners should start with simple tools like Volume Profile and the DOM while gradually exploring more advanced strategies.

What are the best tools for order flow trading?

Key tools include Depth of Market (DOM), Time & Sales, Volume Profile, Delta, and Footprint Charts.

Can order flow trading guarantee success?

No trading method can guarantee success. However, order flow trading equips traders with valuable insights to make better-informed decisions.

How long does it take to master order flow trading?

Mastery depends on individual effort, screen time, and market familiarity. For most traders, it takes months to years of consistent practice.

Order flow trading is a powerful technique that gives traders a real-time window into market activity. By leveraging tools like the DOM, Time & Sales, and Volume Profile, traders can better understand auction dynamics and make more informed decisions. Remember, while it takes time to master, the benefits of order flow trading make it a worthwhile pursuit for any serious trader.