In this video I review the tape with Eric during the day of Monthly Opex – Friday August 21st, 2020.

You can watch the video or read the transcript below.

I didn’t spend much time editing this video + it’s more of a conversation of Eric and I reviewing the tape.

Let’s see if we look at sort of the beginning of the day today, and we go to that spot that you were just talking about, which is right here.

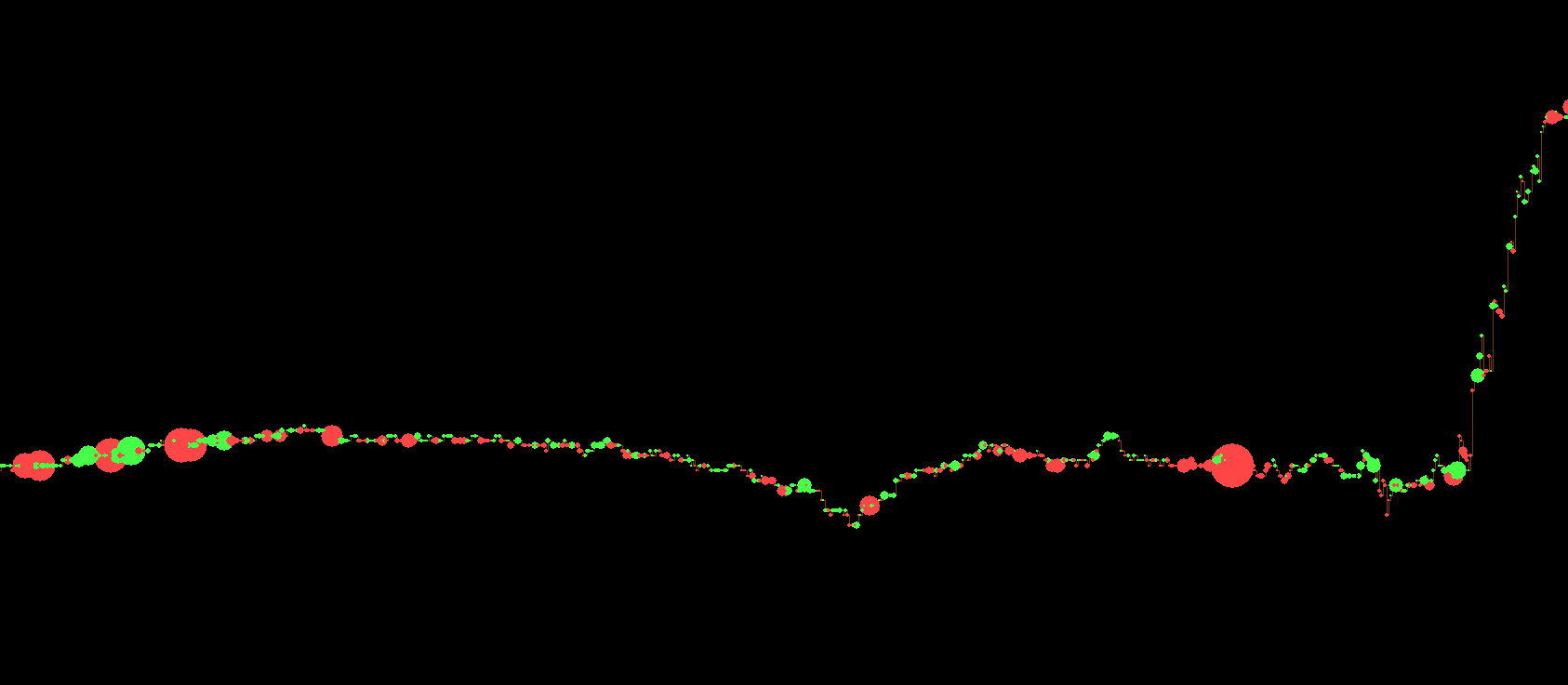

All right. So first off, I mean, I mean, obviously you saw this, this green ball, right. And this is what we’re talking about. You got short somewhere around here and then it came down and then it whooped back up, right?

Hello? Yeah. Yep. Okay, cool. Um, sounds good. So. Essentially, what I would be asking is like, what happened before, right. And how do you interpret what happened before the market opened up, you know, six 30, somewhere around this area and then a bunch of cells happened and then, you know, the market only got so far given all of this volume and you probably.

I don’t know. Why don’t you explain to me, like, if you were looking at this, you probably saw, okay. There was a bunch of cells in now we’re at a spot where they started selling it, which maybe is a good opportunity to get back in short. Um, which is definitely a good play. Right? You, you saw this green ball try to fade it and you know, it only gave a point or two.

Um, and I think it’s a good plan, you know, you have, if you get in. Right around this area. And your stop is a point. You have a great risk reward ratio because you have potential sellers that will defend their positions. And you have a potential also seller who got maybe like it could have been any of these guys that threw away their position.

Right. So even though the sizes don’t match, so that’s probably not my first thought. Right. These are all five hundreds and this is a 600. Um, so I wouldn’t think that’s one of these guys throwing their position away. I don’t get to rotate back to that 76 50 area.

Sorry. Can you say that again? I thought we could rotate back to that 76 50 area sort of in the middle of that lower, big red. Well, yeah. Yeah. So one thing that happens. Kind of how I would read this one would be that this was, um, exhaustion or it’s like the ending of a move and around this area that would have confirmed it.

But then we traded down, um, which I think is, is confusing. Usually that doesn’t happen. You’ll see, you’ll see these. Red balls at the very end of a rotation down or the green balls at the top of a rotation up. And these, this is a super tight range, right? You’ll maybe we’ll scroll over to the right and find a different time where this happened.

Um,

but, uh, here, I just wouldn’t be considering these as being necessarily ending. Moves and again, today’s OPEX. So it’s super confusing the tape to begin with. Um, and that’s why I don’t like trading OPEX. I, I don’t think he did anything wrong here. I think that was a good trade. And hopefully you had your stop right above this, and then you were, I mean, you were wrong in that.

That’s fine. Right. Then, you know, traded up. So be it. So I actually did not put a stop there and I ended up adding up at that 82, 50, 82, 75 area. Okay.

Hoping it would come back to that 79 50, which it did not. And then I scratched up. Yeah. Yeah. That’s, that’s not what you want to do here because let’s see if we can find a good example of. What I would like to call these like Ender moves.

So you usually looks like these are a little too small, but usually it looks like this you’ll have, at least this is one way that it’ll look like, because you have consecutive in a row. Red cells that happen. And usually it starts with a larger one. So it’s like large, small, false, small, and then immediately it’ll reverse.

Um, it can, it can do this role dip a little bit further down, but then I’ll reverse and then I’ll continue. And that’s usually, again, you don’t want to be trading. You don’t want to make them move through this area. You want to make your move around here. Once you start seeing these greens coming in. That are starting to hammer the offer.

And they usually look like a little like rapid fire one after another. And then that’s a great risk reward as well, where you would just enter here or here, if you’re a little late into the position, but you’re watching this happen. And, and also you have like this sort of double this absorption that happened right here.

Well, you don’t have any buys, but you just have cells that didn’t move the market down. And this one, that’s 122, which should have at least maybe given another ticker two, but it didn’t. And then we just bounced back up. So there’s all these different ways that you can trade the tape, but you just have to be kind of in tune with it.

And it takes a while to watch this and really get used to it. Let’s see if this one wasn’t under. Yeah. So this was a great example of, of what you were trying to do earlier. Very top of the move. You don’t get any movement back up and it just comes back down immediately. And it’s a large order. Where do you like to enter on those?

Sorry. Where, where would you like to enter on those? Typically? The, so this is a super fast trade. Um, ideally this is going to be really hard to enter right away, because you’d have to have your finger on the trigger and just send the order right away. But ideally this would come back up, test it. And this is where you enter it here with a very tight stop.

Maybe you’d give it a point and then. It should come back down. It doesn’t always happen. Right. But that is, it’s a fast trade, you know, you’re wrong very quickly. And then if it works out, you’re going to get a pretty large move down. Um, so this one you’d probably end up chasing it somewhere down here. And then you’re probably not at a good risk reward ratio, but you know, it’s still still trade.

This is just so hard. Yeah. And this is what I would call an ender. Right. What about, what about as you scroll to the right, those three red ball down near 81 50? Yeah. This is probably just sellers trying to push the market further down is my guess. Um, let’s see. What’s to the left here. You have this big red seller.

The way that I would look at this is if you’re already in a short here, you want to see price straight through this line right here and let’s see what happens. I’m not sure if it even does it’s. This is so ugly with OPEX. Usually you don’t get all of these random. I mean you do, but it’s usually a little bit more, it makes a little bit more sense.

Um, but anyway, the idea is that you would want to see this under this level. And then if it wasn’t OPEX, I’d be thinking, okay, we’re going to get, you know, a good rotation down. I don’t know where the low of the day is, but you know, maybe target that. Um, and. This cluster right here is what I was talking about, where you get a large one and then you get consecutive smaller ones.

so you got this large four 17, three 20, and then you can, you can’t really make the 200 out, but this looks like buyer’s throwing away there. These are stops essentially. And then usually this is also a good setup to then get long. And again, you don’t want to just throw, like, throw yourself into a position right away.

Usually what I like to do is wait a little bit to see what happens. And then once you start seeing price, this will happen very quickly, typically. So, but you’ll see these like rapid fire greens. That will show up in the tape and that’s your entry long. And if, even if you get in right up here, your stop is somewhere down here.

Or maybe you can use the line as your stop right underneath it. So, but, but with the tip, you just have to be on your game all the time, because it’ll happen so fast.

Yeah. And I don’t see any, anything interesting over here besides maybe these green buys over here, but you can see, like, if you zoom out, you see how there is just rapid fire through here. I mean, it takes it’s over the course of let’s see, nine Oh two, two nine six nine Oh seven. So over five minutes. Um, but once you see this, it really gives you the confidence that there will be continuation in your long position.

And same thing will happen on the, on the short side, it usually looks different on the short side, you’ll get more larger orders, um, pushing the market down, but on the, on the way up, usually see these like

just looked like little bullets on the tape.

So, I don’t know if that helps. Do you have any questions? Yeah. Ideally, where would you be getting in on that reversal? Just show me that again. So if you’re really paying attention, you’ve noticed that this happened, right. You’ve noticed big order, medium smaller, and let’s see if we zoom in here, you have about a minute.

From this order from eight 59 to nine Oh one to really see what happens and get yourself ready, because it could very well come down. Right. Um, can you yourself ready to potentially maybe across, above this four 17, cause if this is a real seller, they will try to defend their position. If this is somebody getting stopped out and then the market’s just going to reverse back.

You can get in and be pretty confident that it’ll just continue up or you’ll be wrong very quickly. So ideally I’d be, you can either just set, set, like a buy stop right here at 79 50 with a one point stop or maybe two point stop and then it either works out or it doesn’t right. Cool. Yeah. I think one thing that is, it’s hard with folks that are trying to start to read the tape is you get a ton of noise, right?

So this looks like tons of bubbles. It sounds like green and red and your job is to read that story and Swift through the noise and look for setups that you’ve seen over and over again, like, you know, this ender move. Stop stop runs and stop runs. Um, and then stuff like this right through here is, is what’s confusing sometimes because you don’t, you don’t really know what to make out of this.

And that’s what can make it difficult. I mean, it’s not why, why are those like that little again, that red cluster around seven 58, seven 59. Why is that? How is that different from the ones that you see. Um, later that was the under, um, seven 50. Let me just look right through 59 and just, just that, um, you know, you’re coming down and then you kind of hit that cluster of red big, bigger down further there.

Yeah. Yeah. How is that different from the ones we were talking about? So this one compared to these ones over. Yeah. Uh huh. Um, so. What I like to look at for the stops is, is large, smaller, and smaller and smaller and smaller. And this is all around the same size, which sometimes can just mean that they’re trying to push the market down.

And I don’t know if you watch my video that I made the other day on the FOMC. Yeah. Yeah. So you had like, this continues, you know, 200, two 50, 300 that were pushing just the market down, over and over. Um, and sometimes, you know, those were more spread out on the , but sometimes you’ll get them like the, like this and, you know, they did push the market down for, I don’t know, maybe three points or so.

Um, but then you can start seeing like right here, there’s someone absorbing. Right through here, push it up. It comes back down, absorbed again, you know, and then they keep trying and then eventually they let, they let up, whoever was absorbing right through here, and either they threw away their position or, you know, they, they finally decided to step in your stream.

Got caught out. Oh, really? Hang on.

Okay.

So yeah, if you can see it now, I mean, you could, you could tell that there was someone here absorbing the cells and then they finally gave up. Or they lifted let the market come down, wait for somebody else to get stopped out. And then they stepped on the accelerator. And that’s kind of the story that I see through this whole area over, you know, an hour of trade

I think it’s really hard with, with OPEX, but I’m guessing if that buyer still. In the game, which I’m guessing they are, we’ll likely going to see more and more upside later today.